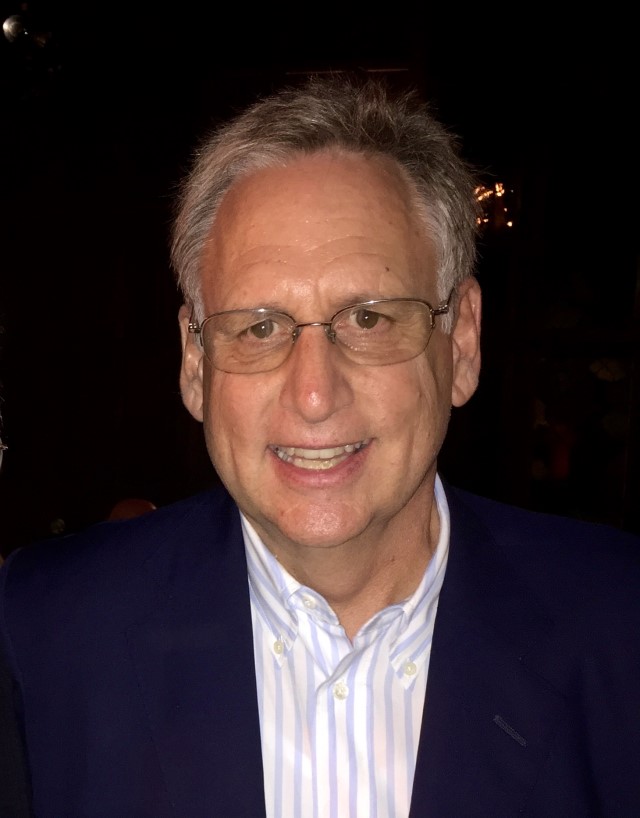

R. Christian Evensen

Mr. Evensen has spent his career structuring and managing debt and equity transactions in corporate, derivative, life sciences and real estate investments.

He is the founding partner of Alpinista Investments, a family business in Nevada that structures and invests in early-stage life science and venture capital investments, and algorithmic trading models. Before founding Alpinista Investments, Mr. Evensen established Flintridge Capital in 2006, which created algorithmic trading programs for use in his family office. Mr. Evensen was a founder (in 1990) and managing partner of Canyon Capital Advisors (which managed more than $10 billion of hedge funds, separate accounts and collateralized debt obligations) and Canyon Capital Reality Advisors (which managed over $1 billion of real estate funds and separate investments) — both investment advisers registered with the U.S. Securities and Exchange Commission. He was also president of Canyon Partners, a National Association of Securities Dealers broker-dealer. During the 1980s, Mr. Evensen was a senior vice president and director of the senior debt and international markets groups in the high yield bond department of Drexel Burnham Lambert. Prior to working for Drexel, Mr. Evensen was a vice president of the currency and interest rate derivatives group at Merrill Lynch, where he specialized in designing derivative contracts for domestic and international corporations. Mr. Evensen began his career at the Bank of New York and First Interstate Bank, focusing on financing in Asia and corporate derivatives transactions.

Mr. Evensen is a trustee of Johns Hopkins Medicine, a Johns Hopkins Medicine International board member and chair of the Johns Hopkins Prostate Cancer Advisory Board. He is also a board member of the Prostate Cancer Foundation and chair of the foundation’s Discovery and Translation Committee and Development Committee.